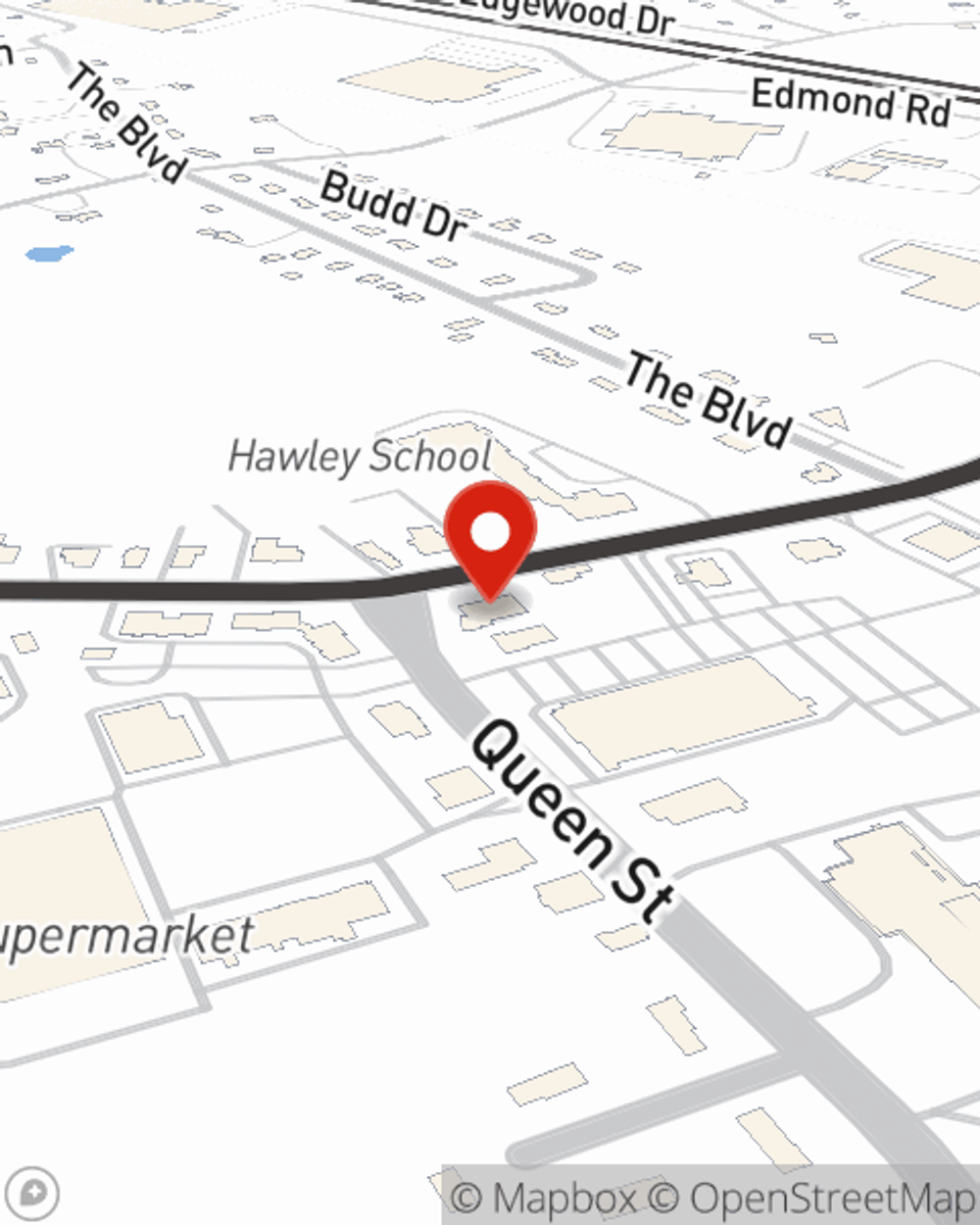

Business Insurance in and around Newtown

Get your Newtown business covered, right here!

Helping insure businesses can be the neighborly thing to do

Your Search For Remarkable Small Business Insurance Ends Now.

Do you own a hearing aid store, a hobby shop or a yogurt shop? You're in the right place! Finding the right protection for you shouldn't be risky business so you can focus on navigating the ups and downs of being a business owner.

Get your Newtown business covered, right here!

Helping insure businesses can be the neighborly thing to do

Insurance Designed For Small Business

Your business is unique and faces a wide array of challenges. Whether you are growing an art store or a pizza parlor, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your space, you may need more than just business property insurance. State Farm Agent Eric Hellriegel can help with business continuity plans as well as key employee insurance.

Let's talk business! Call Eric Hellriegel today to learn why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Eric Hellriegel

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.